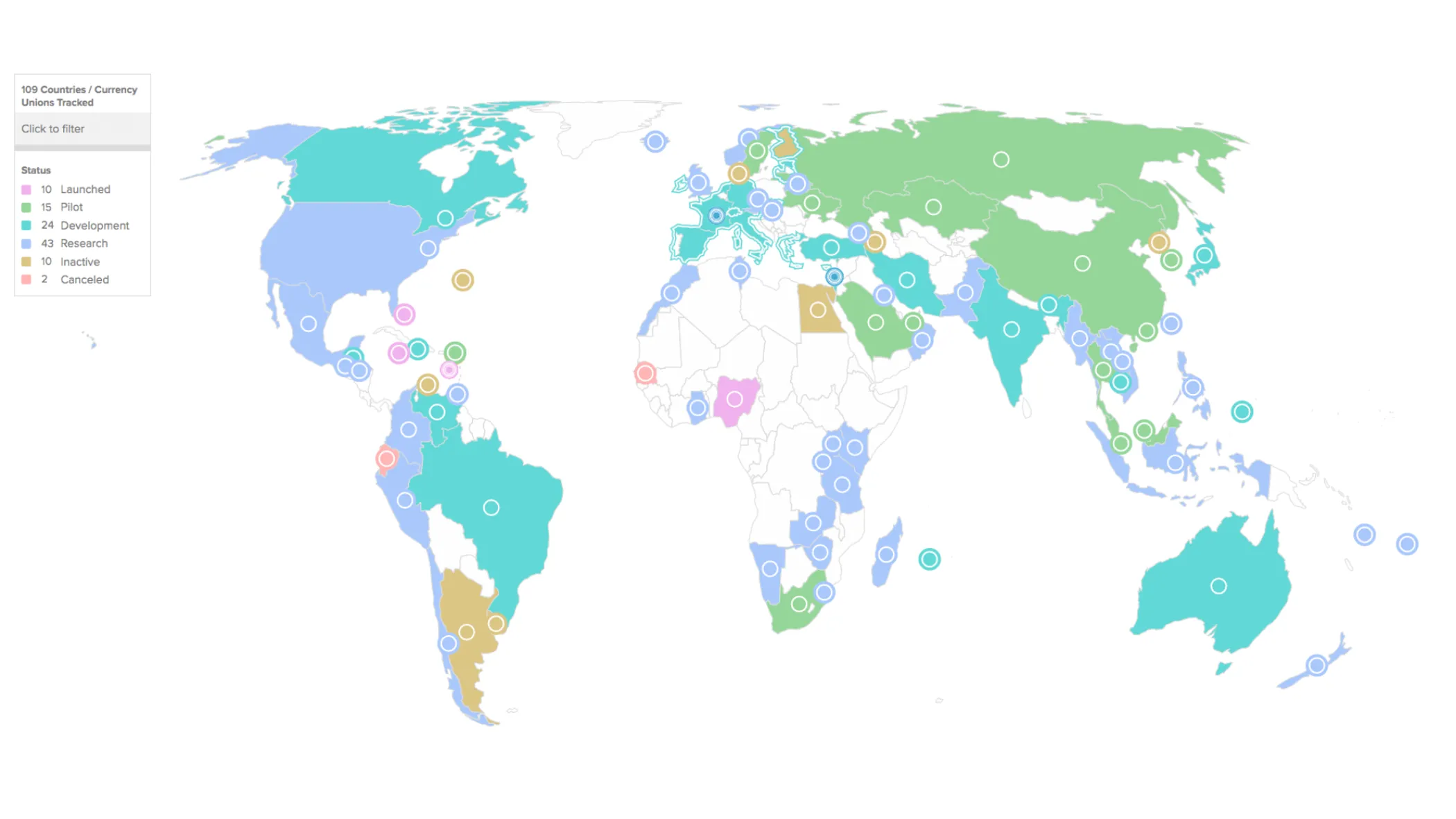

Kazakhstan has been working on a digital national currency since 2021 when the National Bank of the country launched the pilot project. Cryptocurrencies are known to be a high-risk-high-reward kind of endeavor as their value rocket and plummet through the seasons. Is digital tenge going to be the same as Bitcoin or Ethereum?

QazMonitor studied what will make it different and why the regular person can actually find digital tenge useful.

What is digital tenge?

It is just a new form of national currency. Today, Kazakhstan already has two forms of money: cash money (banknotes and coins) and non-cash money (money in bank accounts).

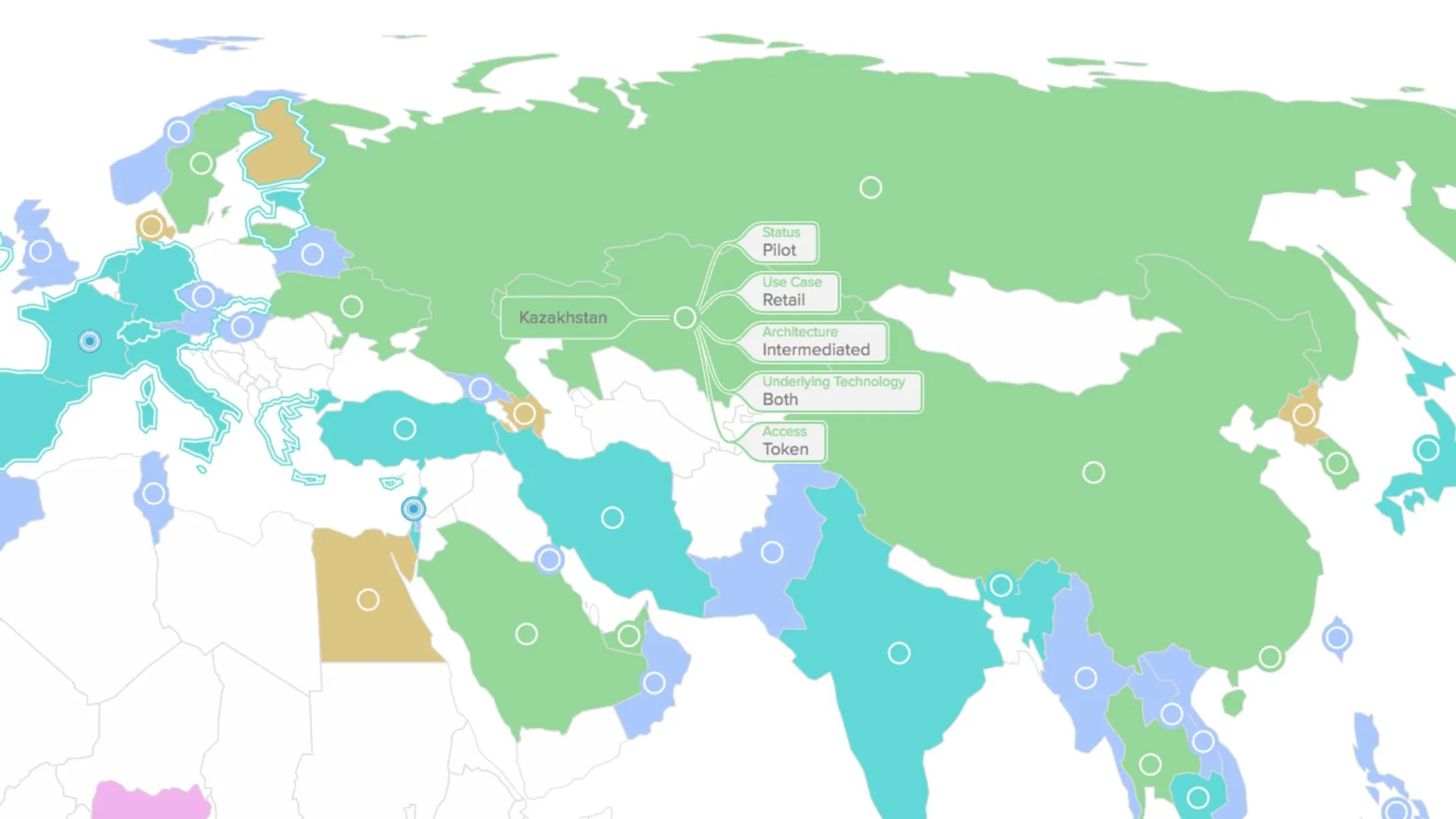

Digital tenge will be universally accepted as a legal means of payment and will perform all functions of normal money for all subjects of the economy. According to the project, the digital tenge will be issued in the form of a unique digital sequence (tokens) or electronic records stored on special electronic wallets.

The launch of the digital tenge will not disrupt the circulation of cash or non-cash money in Kazakhstan. The digital currency will simply co-exist with them.

Why should the public care about it?

For end consumers, there will be no big difference in direct payments compared to current forms of payment - payments in digital tenge will be available through existing payment instruments: mobile applications, QR, and NFC.

However, among other things, there will also be new opportunities, the first being the ability to pay offline. You will be able to use your smartphone to pay even without an Internet connection.

Digital tenge will also ensure further growth of non-cash payment in the region and increase the availability of financial services. In the future, the introduction of digital tenge will also increase the efficiency of cross-border payments.

Is it going to be unstable like Bitcoin?

The digital tenge will be issued only by the National Bank of of the Republic of Kazakhstan. In other words, trust in digital tenge is provided by the guarantee of the National Bank.

For comparison, electronic money is issued and circulates within a particular system of electronic money and is the obligation of the owner of the system. 'Stablecoins' and cryptocurrencies cannot perform all functions of money as a means of circulation, accumulation and payment, as well as a measure of value. They lack a single issuer that could guarantee the protection of holders' interests, and their value is subject to fluctuations.

Will digital tenge allow the National Bank or other state agencies to monitor all my transactions?

No, the technology of digital tenge is aimed primarily at efficient and secure payments, which provides full protection of the rights of consumers of payment services in accordance with the laws of Kazakhstan.

In order to ensure the anonymity of payments in the infrastructure of the digital tenge, appropriate architectural solutions will be provided. In order to combat fraud, illegal turnover of funds and counteraction to the financing of illegal activities, approaches will be used to protect the interests of citizens, the National Bank comments in the official FAQ document.

When will we have digital tenge?

Short answer: we will know at the end of 2022. But here is what has been done so far about the pilot project, and what there is to expect.

The main objectives of the 2021 Pilot Project were to test the Digital Tenge concept’s feasibility through experimental confirmation of the retail platform’s technological viability based on distributed ledger technology, as well as to determine the main parameters of the CBDC Model for Kazakhstan in cooperation with all stakeholders.

In 2022, the National Bank continued to study the benefits and costs of the possible implementation of the Digital Tenge. Currently, there is an ongoing work to expand the platform’s technological functionality and quantitative economic research.

In order to involve financial market participants and other stakeholders, the Digital Tenge Hub collaborative platform was launched in June 2022 bringing together all interested parties to jointly study the issues of implementing a national Digital Currency in Kazakhstan.

In order to complete the assignment given by the Head of State, the National Bank developed a Decision-Making Model on the implementation of Digital Tenge to develop a recommended decision on the need to create national Digital Currency in Kazakhstan to provide related comprehensive study, and to determine the benefits and costs of the possible implementation of Digital Tenge.

Until the end of 2022, the study will analyze technological, economic and regulatory aspects, which will be assessed using technological experiments, surveys, economic modeling and the results of discussions with financial market participants and the expert community.

The decision to implement Digital Tenge will be made at the end of 2022 based on the results of a comprehensive study of potential benefits and risks, technological aspects development, assessment of the impact on monetary policy and financial stability, and possible effects on the National Payment System and its participants.

If you want to learn more about the project, QazMonitor recommends you to look at the reports published by the National Bank.

Similar articles: