Kazakhstan ranked third in financial literacy in the survey conducted among eight CIS countries.

The 2021 report of the Organization for Economic Co-operation and Development (OECD) showed that only Belarus (61,4%) and Uzbekistan (59,9%) scored higher than Kazakhstan (59,6%).

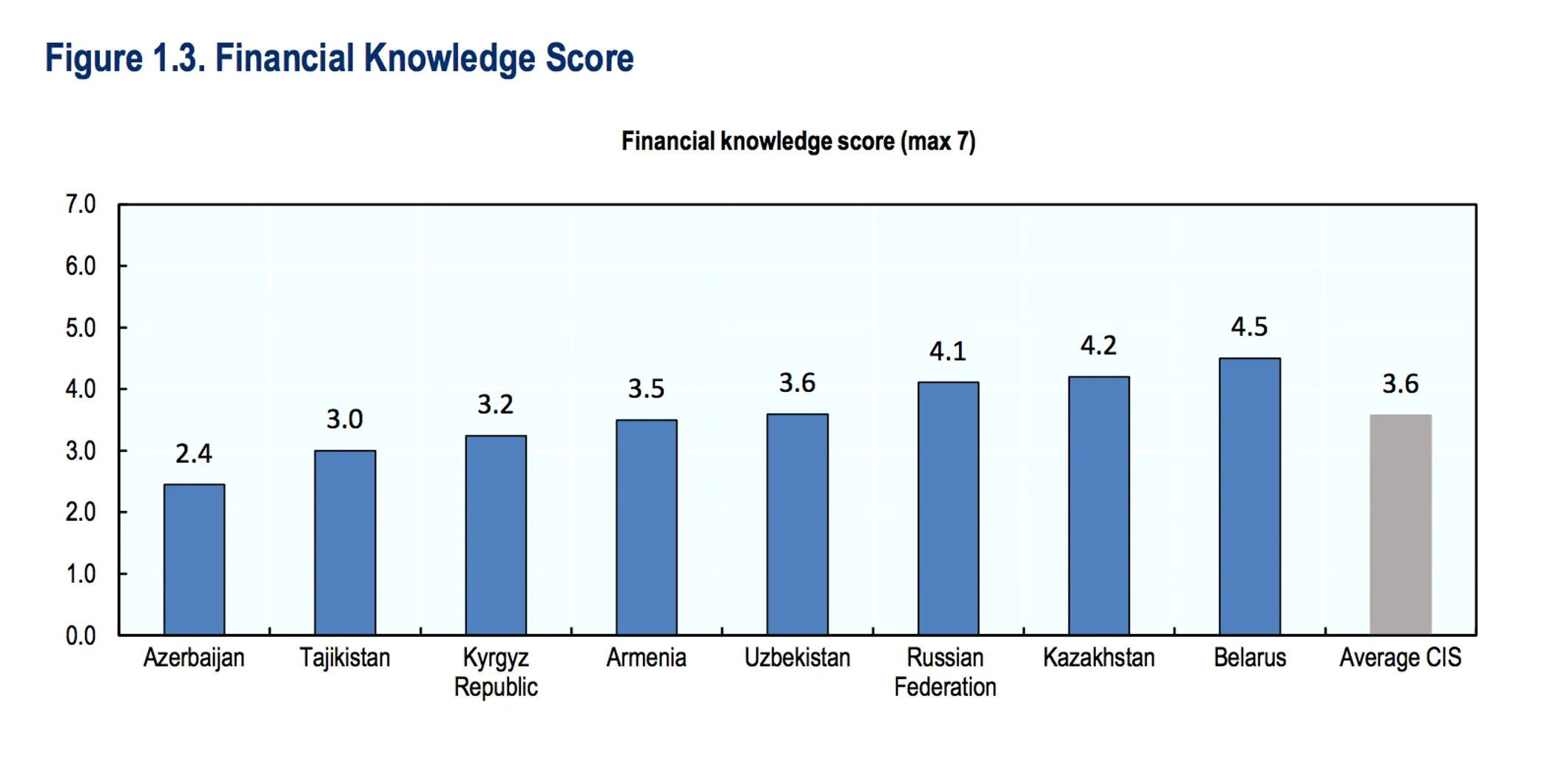

The is good news. But it still leaves room for improvement. Out of the 7 questions in the survey, Kazakhstanis got an average of 4.2 questions right. According to the OECD, this means we are getting more financially literate. Some statistics in the report are admittedly rather disappointing (for example, the results for shortfall and long-term planning) despite being considered the regional average.

Want to test just how money savvy you are?

QazMonitor studied the report, picked out the most interesting figures, and pulled together brain-teasing questions straight out of the paper – just for you.

What is the research about?

The research studied how well people take care of money, their saving behavior, coping with a financial shortfall, detecting fraud (such as financial pyramids) and trusting a reliable source of support, as well as patterns of financial product awareness.

OECD gave each country scores in three categories: financial knowledge, financial behavior, and financial attitude. The organization interviewed 1,000 adults in eight countries each: Kazakhstan, Uzbekistan, Kyrgyzstan, Armenia, Tajikistan, Azerbaijan, Belarus, and Russia. The rating is not the percentage of people financially literate, but how literate they are. Take a look at the overall findings.

How strong is your financial knowledge?

Q0. (Warm-up question, not graded) Imagine that five brothers are given a gift of 1,000 tenge in total. If the brothers have to share the money equally how much does each one get?

Q1. Now imagine that the brothers have to wait for one year to get their share of the 1,000 and inflation stays at 5%. In one year’s time will they be able to buy:

A. More with their share of money than they could today

B. The same amount; or

C. Less than they could buy today

Q2. You lend 5,000 tenge to a friend one evening and he gives you 5,000 tenge back the next day. How much interest has he paid on this loan?

Q3. Imagine that someone puts 100 tenge into a savings account (no tax, no fees) with a guaranteed interest rate of 2% per year. They don’t make any further payments into this account and they don’t withdraw any money. How much would be in the account at the end of the first year, once the interest payment is made?

For the next question, you will get a point for it only if you answered Question 3 right. If you get it, you may feel proud, as only 21,6% of Kazakhs answered both Questions 3 and 4 correctly.

Q4. How much would be in that account from Question 3 at the end of five years? Would it be:

A. More than 110 tenge

B. Exactly 110 tenge

C. Less than 100 tenge

D. Impossible to tell from the information

For the last three questions answer whether the statements are True or False:

Q5. An investment with a high return is likely to be high risk.

Q6. High inflation means that the cost of living is increasing rapidly.

Q7. It is usually possible to reduce the risk of investing in the stock market by buying a wide range of stocks and shares.

That concludes the test. Before we reveal the answers, let’s see what else we can learn about ourselves from the report.

How good are we with money?

We nailed some sections: adults in Kazakhstan scored above average in financial literacy and its elements of knowledge and behavior, as well as in financial well-being.

Confident, but not too much: adults in Kazakhstan showed moderate confidence in their own financial knowledge with 22% assessing it is high, a little more than the CIS average (19%).

Most of us don’t plan for tomorrow: some 43% of surveyed individuals in Kazakhstan plan for the long term, far below the average of 58% across the CIS.

Keeping pensions private: of all the CIS countries, the highest proportion of adults relying on private pension schemes (some 59%) is in Kazakhstan.

Few Kazakhs have ‘rainy day’ fund: moreover, only 9% have savings to last over six months but 11% reported having savings to last less than one week.

The report concludes, that in many respects, adults in Kazakhstan have average levels of financial literacy and experience dealing with finance in the CIS.

Time to reveal the answers

We hope you found the questions interesting and challenging enough. The correct answers are as follows:

Question 0: 200 tenge

Question 1: C. Less than you could buy today

Question 2: 0% interest. He gave you back just the same amount of money.

Question 3: 102 tenge.

Question 4: A. More than 110 tenge. If you got 2 tenge in the first year, then each next year will give you slightly more than 2 tenge. For example, in the second year, 2% of 102 tenge is 2.04 tenge.

Question 5: True. Compare it to saving accounts: the risk to lose your money is low, but you will not have a high return either.

Question 6: True. The higher the inflation, the less your money is worth.

Question 7: True. Don’t keep all of your eggs in one basket.

How can we make people more financially literate in Kazakhstan?

The majority of OECD members are high-income economies with a very high Human Development Index (HDI) and are regarded as developed countries. Policy makers of the organization gave the following recommendations to Kazakhstan:

Continue structured efforts to provide financial education programs to as many adults as possible. Improved basic financial knowledge will help address weaker areas, such as simple interest and interest compounding, and, to a lesser extent, understanding of risk and diversification and the value of money across time. Women, young people, retirees, and the unemployed are groups that could benefit from tailored financial knowledge support. Supporting prudent financial behaviors may help boost individual savings.

Enhanced international cooperation in financial education and literacy may help the adoption of novel and globally-vetted tools for financial education. Kazakhstan would need to move beyond the average trends of the CIS in financial literacy to experience benefit the rest of the economy, the rapidly-developing financial sector in particular.

The OECD founded in 1961 to stimulate economic progress and world trade. The member countries of the forum describe themselves as committed to democracy and the market economy, providing a platform to compare policy experiences, seek answers to common problems, identify good practices and coordinate domestic and international policies of its members.