Bank CenterCredit was established in a time of change, in 1988. Looking back, the symbolism behind the name of the bank becomes even more apparent: the Latin word for "trust" is "credit". In those years, the disadvantages of the Soviet financial system were already obvious, while Kazakhstan's financial system was still in its infancy. Therefore, the new financial institution undertook the mission to become a center of trust and financial support for the citizens of the country

The Bank, established in 1988, pioneered in building a new financial system in the country. In many ways, the history of the Bank reflects the history of Kazakhstan, and its international cooperation has led to attracting investments and developing business, while constantly increasing the quality of financial services provided.

The brief history of Bank CenterCredit

In 1988, the bank was founded on the basis of Almaty Central Cooperative Bank was registered under the License No. 4 issued by the State Bank of the USSR. A year later, the bank became a member of the Chambers of Commerce and Industry of the Kazakh SSR and the USSR and then opened branches in all regions of the country. In 1992, the bank was issued the General License for banking operations in the national and foreign currencies, as well as a permit to operate with securities.

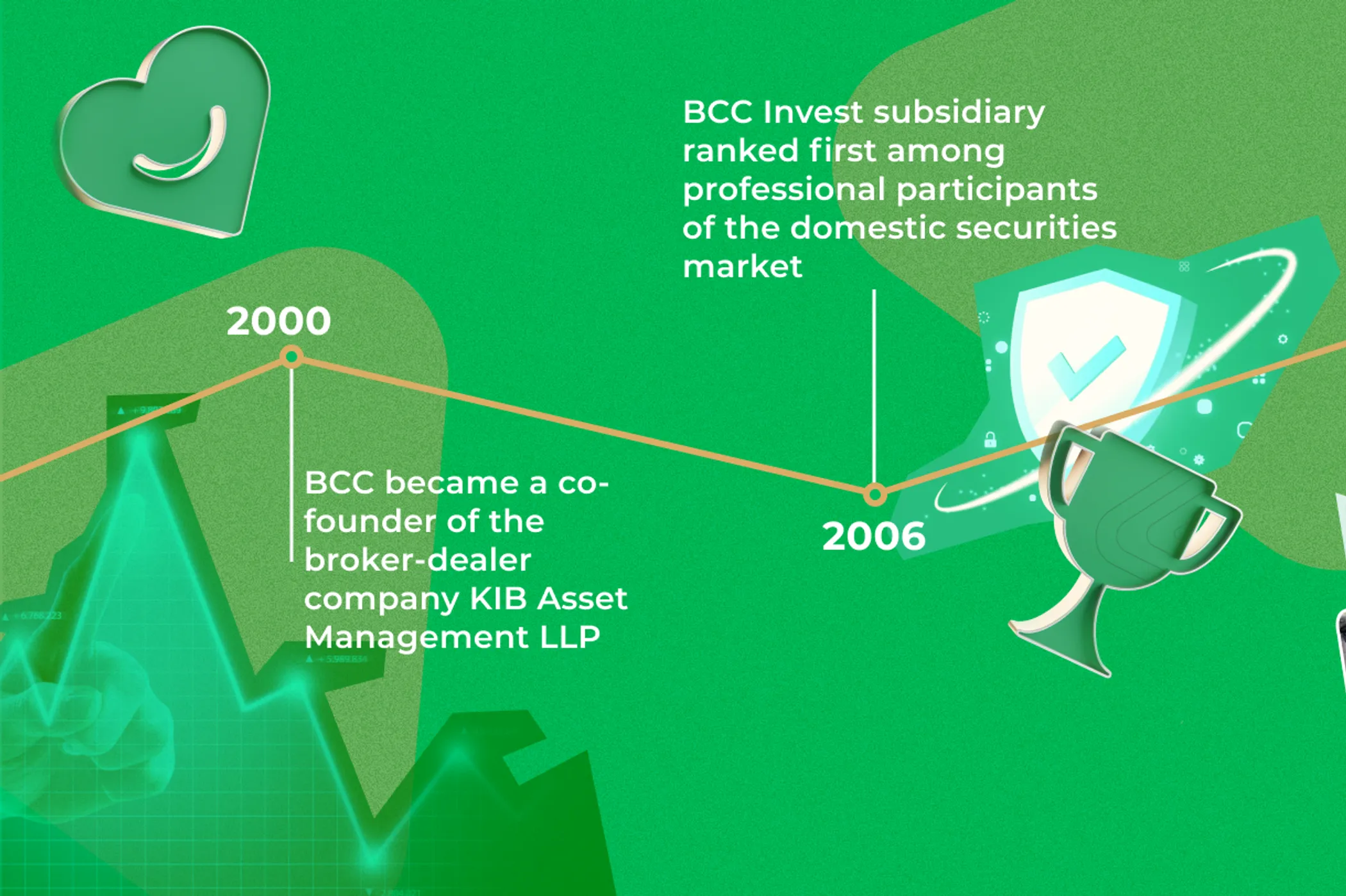

The new millennium started with the bank expanding the range of financial services provided. In 2000, BCC became a co-founder of the broker-dealer company KIB Asset Management LLP and issued its own bonds in the form of subordinated loans for the first time. In the same year, the bank started to carry out custodian activity for pension assets accounting and safekeeping.

In 2006, BCC Invest subsidiary ranked first among professional participants of the domestic securities market in terms of the number of companies listed on the Kazakhstan Stock Exchange and was recognized as one of the market leaders in terms of total securities trading volume.

A decade later, the bank started a joint project with Air Astana airline — a card product for travel lovers called Card for fly. In 2017 Bank CenterCredit became Kazakhstan’s first second-tier bank to successfully complete the PCI DSS Compliance audit (version 3.2).

2018 marked the BCC’s launch — one of the first ones in Kazakhstan — of Apple Pay mobile payment service.

In November 2019, Moody's affirmed Bank CenterCredit's ratings and improved the outlook to Positive. The international rating agency affirmed Bank CenterCredit's international scale ratings. The long-term bank deposit rating and long-term national scale CRR rating were also upgraded. The outlook was revised upwards from "Stable" to "Positive". Just a year later, Moody's affirmed BCC’s ratings at B2 with a Stable outlook.

In May 2022, the Bank closed the acquisition of Alfa-Bank Kazakhstan and re-registered it under the new brand Eco Centre Bank. Two months later, Bank CenterCredit entered top-3 rankings in terms of retail deposits growth and is the third largest commercial bank in Kazakhstan in terms of assets. Corporate deposits doubled, ranking third among the top-10 second-tier banks.

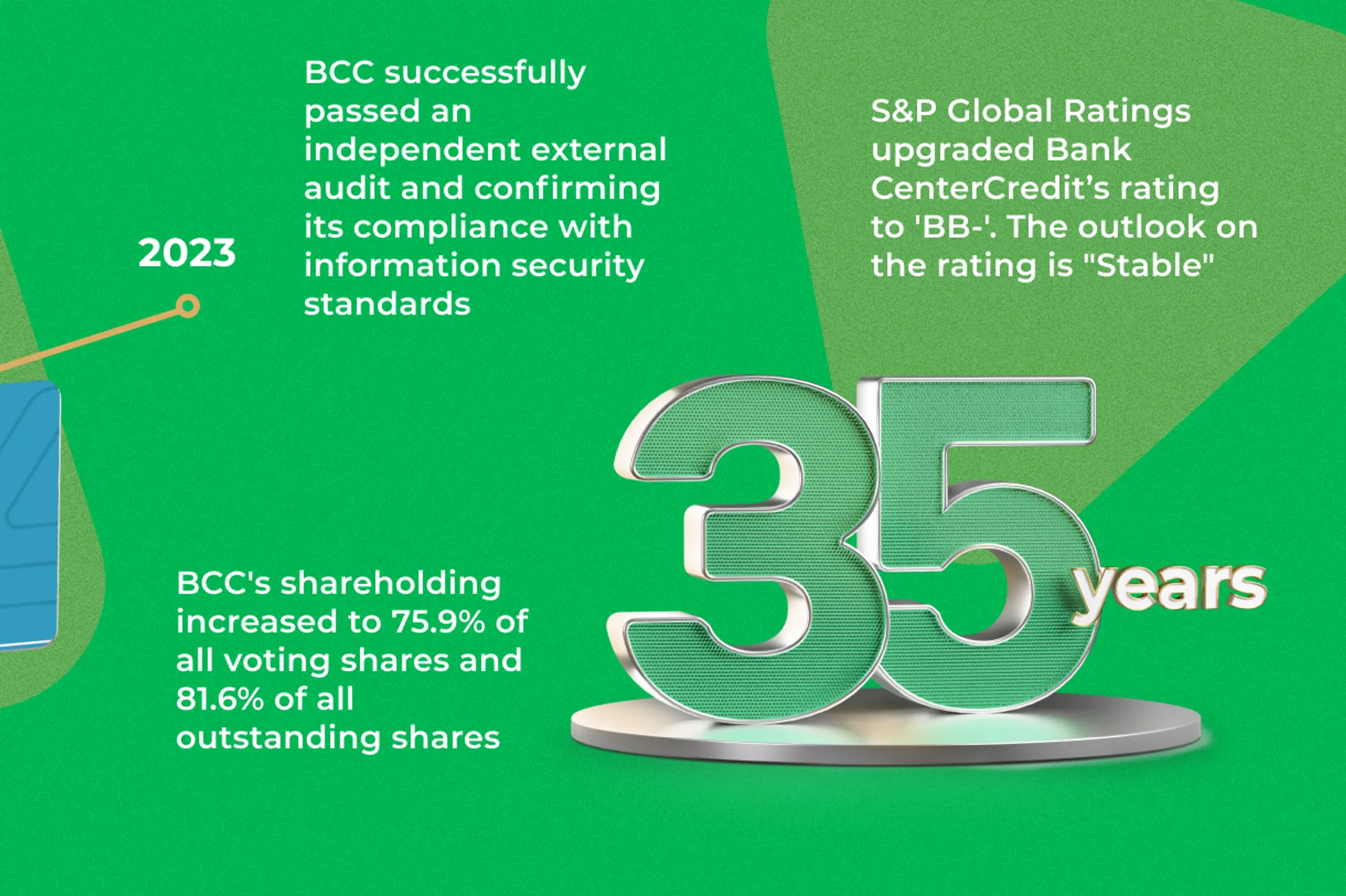

Moving on to 2023, the year started with BCC successfully passing an independent external audit and confirming its compliance with the following information security standards: PCI DSS, PCI Pin Security, SWIFT CSP. In May, Bank CenterCredit acquired a controlling stake in Sinoasia B&R. As a result of the acquisition, BCC's shareholding increased to 75.9% of all voting shares and 81.6% of all outstanding shares.

This summer, Moody's upgraded Bank CenterCredit's ratings to Ba3. The outlook is positive. Moody's Investors Service (Moody's) upgraded BCC's long-term deposit and debt ratings, counterparty risk ratings (CRR) and assessments, as well as the baseline credit assessment (BCA) and adjusted BCA. S&P Global Ratings upgraded Bank CenterCredit’s rating to 'BB-'. The outlook on the rating is "Stable".

International cooperation

As early as in 1993, BCC became a Member of SWIFT Alliance, which allowed it to automate processing of international payments. The Bank became the Founder of the Kazakhstan Interbank Currency Exchange in the same year.

In 1995, BCC was one of the first banks authorized to organize valuables collection and transportation service, and opened one of the first correspondent foreign currency accounts with The Bank of New York. The next year, Bank CenterCredit became the only representative of Western Union international money transfer system in Kazakhstan and Central Asia.

In 2000, the Bank was admitted to Visa International as a participating member, providing Visa plastic card issue and maintenance services. Subsequently, this cooperation strengthened and developed even further, as in 2005, Visa International upgraded Bank CenterCredit's status to Principal Member, allowing issuance and acquiring, as well as making all settlements directly with this payment system.

In 2021, BCC won in 11 nominations according to Visa international payment system.

How BCC helped Kazakhs to become new homeowners

In 1997, Bank CenterCredit took part in the tender held among second-tier banks for reorganization by way of merger with CJSC Zhilstroybank and became the winner. Then, the National Bank included BCC in the first group of banks according to international standards.

The reputable agency Thomson Bank Wath assigned the bank an international credit rating "B". The bank’s shares were A-listed.

Bank CenterCredit was one of the first second-tier banks to become a member of the Kazakhstan Deposit Insurance Fund.

In 2018, the bank was awarded a badge of honor for its leadership in implementation of the “7-20-25” Mortgage Programme (7% interest rate, 20% of minimum down payment, and loan term up to 25 years). BCC accounts for more than 91% of loans issued under the programme.

It is important to note that BCC is the first Kazakhstani second-tier bank to launch the Mortgage for Military. The project was launched as part of the existing mortgage programmes of JSC Baspana Mortgage Organization - 7-20-25 and Baspana Hit, in implementation of which BCC is a leader among Kazakhstan’s STBs.

In 2020, Bank CenterCredit issued the first bank loan with shared participation under the Baspana Hit programme, and also launched metal accounts for gold transactions.

In 2021, the Bank was recognized as the best bank for implementing the 7-20-25 programme. The first mortgage loan involving lump sum pension payments was disbursed. In the same year, BCC became one of the first banks to launch Google Pay contactless payments.

In 2023, Bank CenterCredit launched mortgages without down payment for primary and secondary housing in all regions of Kazakhstan.

Extensive support for small and medium-sized businesses

In 2003, EBRD recognized BCC as "The Most Dynamically Developing Bank" under Kazakhstan's Small Business Programme. The Bank has been developing in this area ever since.

Moving to the present days, the Bank was recognized as the Best SME Bank in Kazakhstan in a survey by GLOBAL BANKING & FINANCE AWARDS, an international rating publisher. Now BCC actively participates in nearly all state programs of entrepreneurship support implemented by Damu Entrepreneurship Development Fund JSC (EDF), as well as cooperates with Asian Development Bank and European Bank for Reconstruction and Development (EBRD).

BCC contributed to the creation and launch of many enterprises, which gave Kazakh citizens hundreds of thousands of jobs and made a significant contribution to the development of the country's economy.

Meanwhile, these activities have a multiplier effect. It is difficult to overestimate the role of small and medium-sized enterprises. By the end of 2022, the contribution of SMEs to the economy of Kazakhstan reached 36%.

Kazakhstan’s authorities have been developing this segment for many years, since globally small and medium-sized enterprises create over half of new jobs, which is crucial for sparsely populated or remote areas of our country.

In 2008 and 2010, BCC received EBRD awards as the Most Active Issuing Bank under the Trade Facilitation Programme in Kazakhstan. The International Finance Corporation also gave BCC the same recognition in 2010.

2014 was the breakthrough year for business loans, and this vector of development has been supported further; BCC signed the Bank Loan Agreement with the Development Bank of Kazakhstan to finance large businesses, Loan Agreement with JSC Damu EDF for attracting funds from the National Fund of the Republic of Kazakhstan to finance SMEs in the processing industry. CenterCredit concluded a 10-billion tenge Loan Agreement with EBRD to finance MSMEs against the guarantee of JSC Damu EDF.

In 2015, the Bank expanded its product line by concluding an agreement with the Development Bank of Kazakhstan on attracting 2 billion tenge for 20 years to support Kazakhstan’s manufacturers though onlending to buyers of domestically assembled cars.

In the same year, BCC concluded the Loan Agreement with EBRD to attract two tranches totaling 3,720 million tenge, each for a period of 5 years to finance women in business.

In 2016, the EDB provided Bank CenterCredit with a $10 million trade finance facility.

In 2018, BCC received a $45-million loan from EBRD. EBRD funds are provided against the guarantee of JSC Damu Entrepreneurship Development Fund as part of EBRD's financing to SMEs in Kazakhstan and the Women in Business programme. Over 60% of loan proceeds will be used to finance SMEs in the regional centers of Kazakhstan outside of Astana and Almaty, and women-led businesses.

In 2019, Bank CenterCredit and the Astana International Financial Centre (AIFC) signed a Memorandum of Understanding for API development. The Memorandum also contains provisions on cooperation between their structures on the issues related to use of the Platform by AIFC participants, development of innovation labs, mentoring support for fintech startups participating in accelerator and incubation programs, and joint master classes and workshops.

Social responsibility projects

Throughout its development path, the Bank has undertaken a mission to become not only a center of trust, but also a socially responsible financial organization. In recent years, BCC has sponsored more than 100 charitable and social initiatives. The main areas supported by the bank are culture, education, healthcare, ecology and sports.

The Bank also actively supports and develops corporate culture by introducing eco-projects and conducting various environmental activities. Bank CenterCredit promotes the principles of conscious consumption. Hosting environmental-conscious events is an integral part of the bank's corporate life.

Earlier, QazMonitor analyzed the BCC’s annual Social Responsibility Report to find out what measures every business owner can take to make a meaningful impact on the society.