Almaty hosted the jubilee 10th Congress of Kazakhstan Financial Experts — Role of the Financial Sector in the Development of Real Economy: Challenges and Opportunities. In the course of "Stock Market. New Investment Opportunities" panel session, Adil Mukhamejanov, Chairman of the Management Board of the Central Securities Depository (KCSD), described the profile of a Kazakhstan investor and explained the reasons of growth of foreign securities issues.

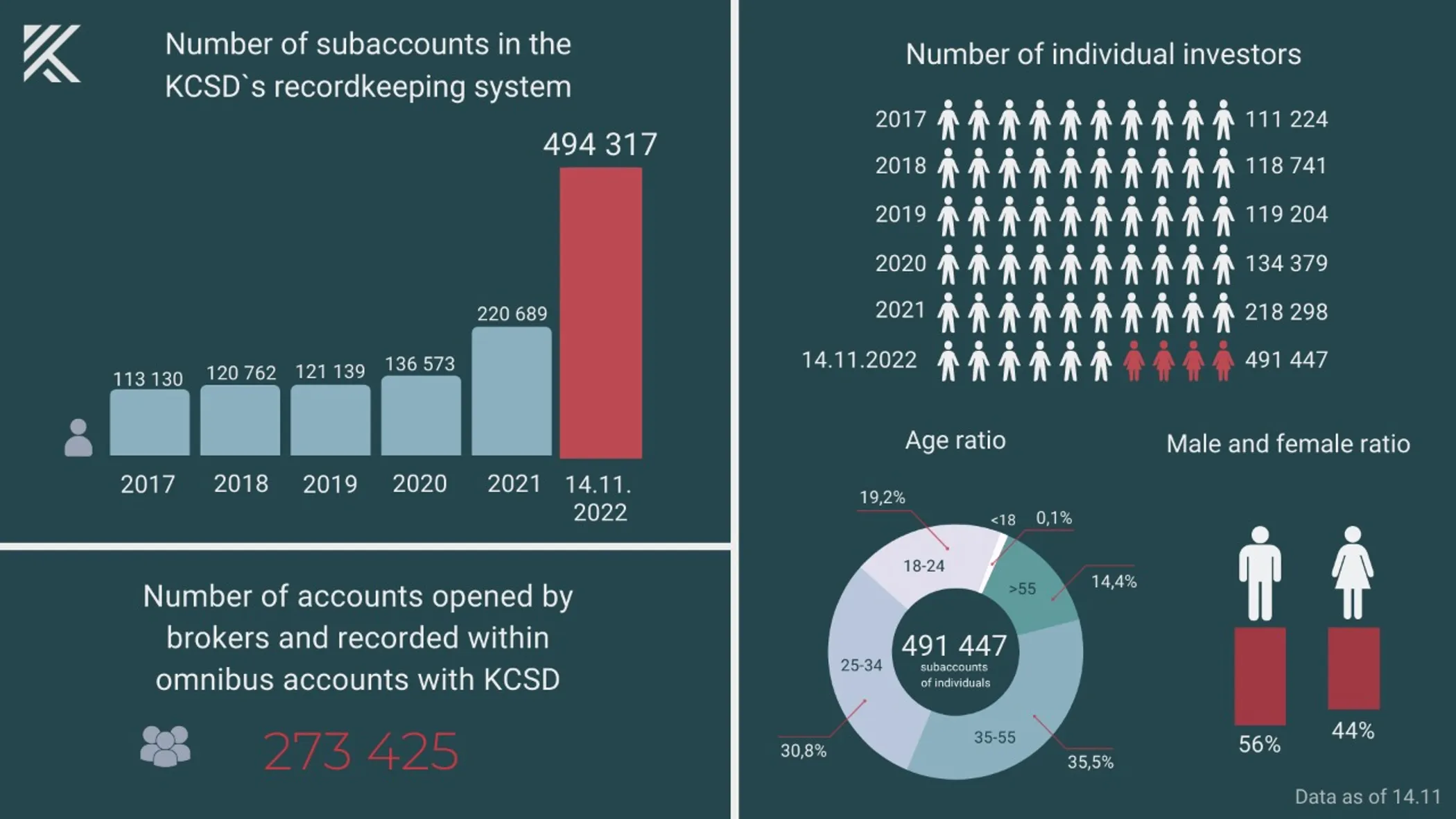

This year, Kazakhstan’s stock market hits the landmark figure. The number of brokerage accounts in nominee holding system of the Central Securities Depository approached the half-million figure – 494 thousand as of November 14, 2022. Since the beginning of November, the number of subaccounts has increased by 17 thousand. Year to date, the number of subaccounts has increased 2.2 times. The mere couple of years ago, the present number of brokerage accounts seemed a long-run target. The highest growth of subaccounts was noted in February – plus 69 thousand subaccounts. Most subaccounts were opened in the name of individuals – about 99%.

Retail Investor Becomes Younger

The profile of a Kazakhstan investor has changed significantly for the past several years, and the investor is younger now. Since the beginning of the year, the number of brokerage account holders under the age of 35 has increased almost three times (2.9 times).

As of November 14, 2022, the group of retail investors aged 25 to 34 made up 30.8% of the total number of retail investors, aged 18 to 24 – 19.2%, and aged under 18 – only 0.1%. The most numerous group is still the group of persons aged 35-54. Yet, from the beginning of the year it has decreased from 40% to 35.5%. The share of investors aged above 55 has also continued reducing – from 21.6% to 14.4%.

The number of women among brokerage account holders has increased 2.4 times year to date. Their share amounts to about 44%, while the share of male retail investors amounts to 56%.

In territorial terms, Almaty (21.5%), Astana (10.9%) and Turkestan region (9.4%) are the leaders. The number of subaccount holders has increased 3.2 times in Turkestan region, while in Astana it has increased 2.4 times and in Almaty – 1.9 times year to date. The least number of brokerage accounts were opened in the north of the country, specifically, in North Kazakhstan region (1.5%).

Omnibus Accounts Gain Popularity

The number of investors serviced via omnibus accounts by KCSD's participants is also growing. Let us remind that, as of July 1, 2021, further to statutory changes, the local participants of the Central Securities Depository were given the opportunity to open omnibus accounts for aggregate recording of customer assets.

“The first omnibus accounts began opening since December 2021. Currently, five participant subaccounts are opened in the Central Securities Depository's recording system for aggregate recording of instruments. The number of personal accounts opened by brokers and recorded via omnibus accounts at KCSD as of November 14, 2022, amounted to about 273 thousand,” said Adil Mukhamejanov.

Number of Foreign Assets Is Growing

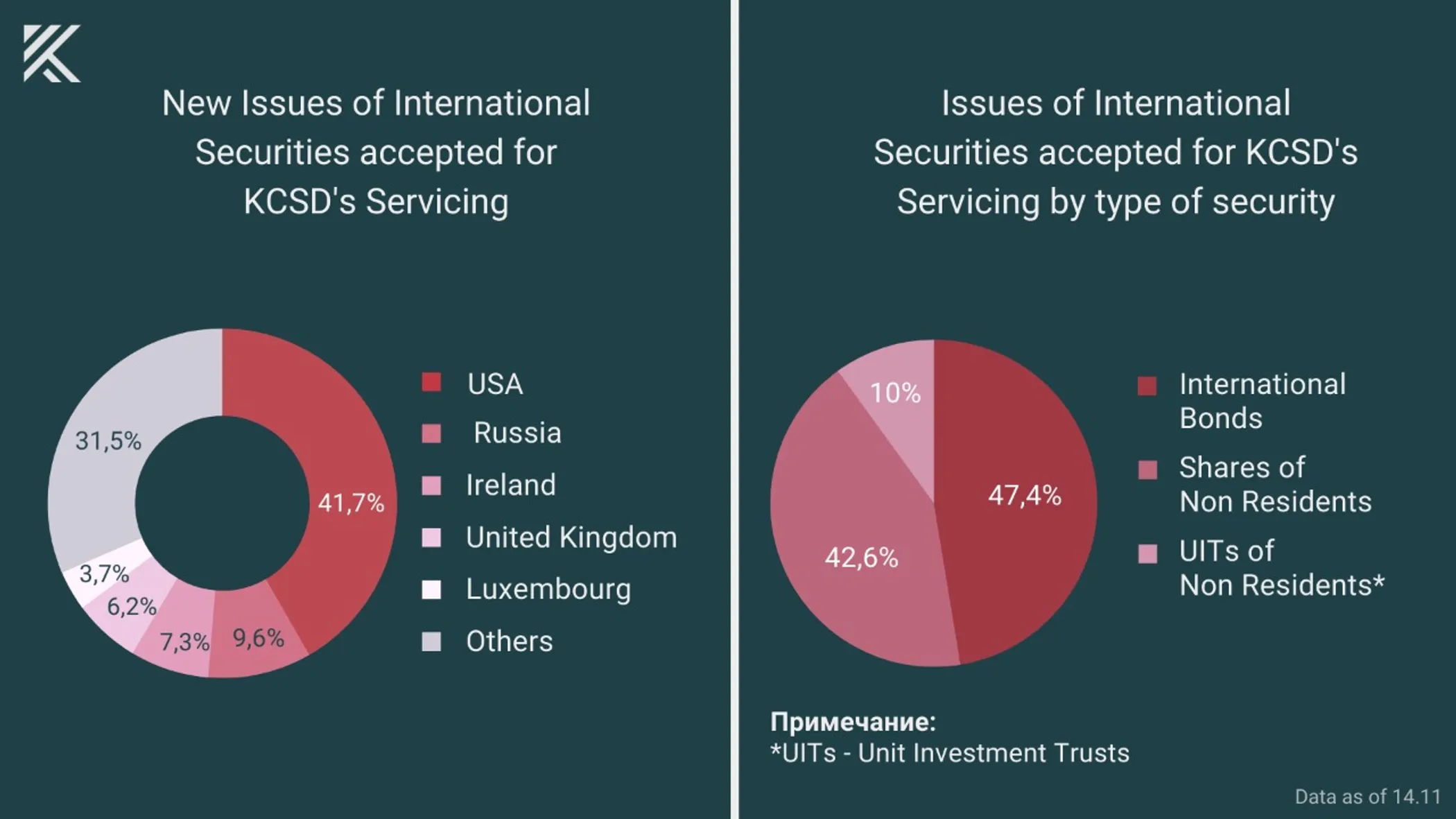

As of late October 2022, the number of issues of securities accepted for depository service at KCSD increased almost twice year to date, from 1,316 to 2,186 issues.

The main reason of such growth is the increase of issues of the foreign securities under depository service of KCSD. As of November 1, 2022, indicative stockholding of securities issued in accordance with the law of other states amounted to over USD 11 billion. At the same time, the biggest portion accounts for issues of US securities – 41.7%.

Almost a half (47.4%) of new issues of foreign securities are bonds. The number of issues of foreign bonds as of the end of October has increased more than three times (from 165 to 572 issues) year to date.

Somewhat less than that (42.6%) accounted for non-resident shares. The number of issues of foreign shares at depository service of the Central Securities Depository has also demonstrated a significant growth: from 143 issues in the beginning of the year to 515 issues as of the end of October.

The remaining 10% account for the securities of foreign investment funds. During nine months of 2022, the number of issues of securities of foreign investment funds at depository service of the Central Securities Depository has increased more than eight and a half times (8.6 times) from 14 to 121 issues.

The growth has mainly resulted from repatriation of assets of Kazakhstan investors having held them at the accounts of foreign custodians, brokers and depositories. We see a certain interest also on the part of non-resident participants of the Central Securities Depository.

"The growth in the number of foreign securities accepted by us for service contributes to the growth of customer assets of the Central Securities Depository, expansion of the activity scale and geography of the exchange business of our customers. All of this lays the groundwork for turning KCSD's infrastructure into a platform for the development of a regional hub,” Adil Mukhamejanov added.

Access to Russian Assets

In March 2022, the Russian government imposed restrictions on transactions with securities for foreign investors, and some securities of Kazakhstan nationals were blocked in Russian record-keeping entities. The Central Securities Depository has described the procedure of funds withdrawal from Russian securities and Russian record-keeping entities with reference to the National Settlement Depository (NSD).

“When we talk about the blocked securities, we mean that a restriction is imposed on an account of the Central Securities Depository of Kazakhstan with NSD, such as C type account, i.e. the restricted-use account. It is allowed to deposit securities there, but it is prohibited to withdraw them. As of October 1, 2022, totally 47 issues of shares and 21 issues of bonds of 51 issuers were deposited there. The indicative stockholding of such issues amounted to about RUB 35 billion. Out of them, about 94% account for the bonds, more than half whereof account for Euronotes of the Republic of Kazakhstan Ministry of Finance that have been issued in accordance with the Russian law,” said Adil Mukhamejanov.

In August, the Moscow Exchange announced permission of non-residents from the friendly countries to the Moscow Exchange markets of shares and bonds. By reference to the NSD, the Central Securities Depository explains that for the purpose of transfer and further sale of Kazakhstan investors' assets, the security holder needs to apply to a Russian broker, open an account at such broker and file the respective orders for withdrawal of securities via KCSD and depositing of the securities via the Russian broker. After the securities are deposited, they can be sold at the Moscow Exchange via the Russian broker.

It is known that the first transactions for withdrawal of securities from KCSD's account at NSD have already taken place, which proves that the procedure is valid.

Upgrade of the Central Securities Depository

The Central Securities Depository is undergoing the active transformation in terms of both digitization and business processes.

The range of services currently offered by us and planned to be implemented has long ago overstepped the boundaries of a classic depository in the form it has existed for these 25 years. One of the key areas we actively focus on is expansion of the offering for the market players and making the existing customer services more convenient. Among our key initiatives are: improvement of personal customer portals, automation of recording and payment of unclaimed cash, development of a corporate action hub and much more.

The works in these areas are already underway. For instance, development of an ecosystem of corporate actions is contributed by the automatic processing for notification of a corporate action in relation to foreign securities. By the end of the year, KCSD is also planning to start disclosing a part of information on the corporate actions of issuers. Previously, it has been the obligation of the issuers.

“Even today, the Central Securities Depository has a potential to assume the role of a regional accounting hub for corporate actions with the following expansion to the capital markets of Central Asia. A wide range of services, including depository services, banking services, registration of over-the-counter transactions, as well as the options for settlements in tenge, US dollars, euros, Russian rubles and Chinese yuan, create favorable conditions for KCSD's infrastructure to become a regional settlement hub,” summarized Adil Mukhamejanov.